PUBLIKATIONEN

ICRAIS 2025

ICRAIS 2025 - Mauritius

Das Projekt TaDeA wird auf der International Conference on Recent Advances in Information Systems (ICRAIS) 2025 präsent sein, die vom 10. bis 12. September 2025 in Pointe aux Piments, Mauritius stattfindet.

Wir freuen uns, mit einer Keynote sowie zwei wissenschaftlichen Beiträgen zum Konferenzprogramm beizutragen und aktuelle Forschungsergebnisse einem internationalen Fachpublikum vorzustellen.

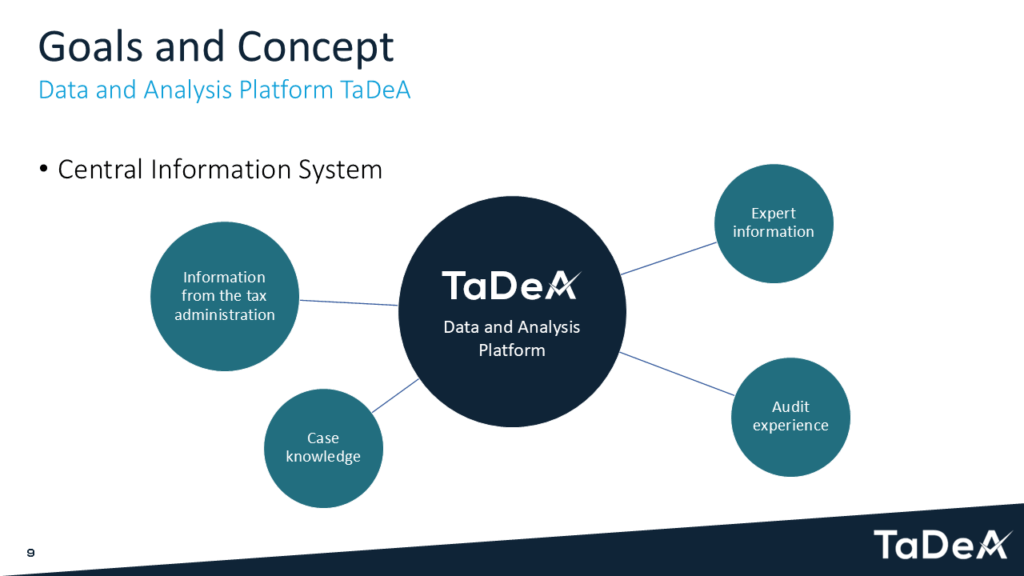

Die Keynote bietet einen eindrucksvollen Einblick in das Projekt TaDeA. Im Fokus stehen die Herausforderungen durch grenzüberschreitenden Umsatzsteuerbetrug sowie aggressive Steuergestaltungen internationaler Konzerne. Wir zeigen auf, wie unsere digitalen Lösungsansätze die Steuerverwaltungen bei der effektiven Bekämpfung dieser Problematiken unterstützen können. Zentrales Element ist unsere Daten- und Analyseplattform mit einer Vielzahl modularer Komponenten, die wir auch in den kommenden Jahren kontinuierlich weiterentwickeln werden. Ergänzend veranschaulichen wir das besondere Potenzial von Large Language Models anhand aktueller und zukünftiger Anwendungsfälle.

Neben dieser kurzen Vorschau der Keynote sind nachfolgend die Abstracts der eingereichten Beiträge dargestellt. Nach der Konferenz werden diese durch die vollständigen Veröffentlichungen ergänzt.

Tax Defense Analytics: A Data-Driven Application for Identifying Cross-Border VAT Fraud and Tax Avoidance Schemes

- 1Carl von Ossietzky Universität Oldenburg

- 2Landesamt für Steuern Niedersachsen

Abstract: In this work we present the current state of a work in progress multi-functional application for detecting cross-border value added tax (VAT) fraud and identifying tax avoidance schemes of multinational corporations. We outline the design and architecture of this data science and artificial intelligence (AI) driven application, which incorporates not only data analytics but additional functionalities, which in combination support and elevate the workflow of the auditors. These additional functionalities include a sophisticated data integration pipeline, a multipurpose AI tool suite, as well as a tax expert knowledge management system. Key challenges in data governance, infrastructure and organizational readiness are discussed. Despite not being finished this approach already shows the potential to significantly enhance the efficiency and effectiveness of tax fraud detection and tax avoidance identification. This work aims to share insights from operationalizing AI in tax administration to facilitate broader digital transformation efforts.

Status: Accepted for presentation. Proceedings pending publication.

Structured extraction and hierarchical parsing of addresses using Large Language Models

- 1Carl von Ossietzky Universität Oldenburg

- 2Landesamt für Steuern Niedersachsen

Abstract: In the era of digitalization and cross-border trade, address inconsistencies present a critical challenge across sectors such as taxation, fraud prevention, law enforcement, and public service delivery. Unstructured and inconsistent address formats – characterized by spelling errors, missing postal codes, incorrect or absent city and street names, and improper punctuation—hinder the effectiveness of automated systems. These issues are particularly detrimental to efforts aimed at combating tax fraud in a European region or international context, where precise address data is essential for accurate entity verification, transaction tracking, and fraud detection. Despite initiatives by tax authorities, postal agencies, and government bodies to enforce standardized address formats, real-world data continues to exhibit substantial variability and noise. Traditional rule-based solutions fall short in addressing the complexity of such data, while existing AI-based methods are often not tailored to the nuances of European address formats. In this research, we propose an approach to transform unstructured address data into structured formats using pre-trained large language models (LLMs), with a focus on the European region. Our experimental results demonstrate that the LLM-based approach significantly outperforms conventional methods in generating structured addresses, and these structured outputs have shown strong performance when evaluated using our rule-based script. This hybrid solution offers a promising tool in the broader effort to ensure regulatory compliance and enforce tax authorities in the fulfilment of their legal mandate against illegal activities.

Status: Accepted for presentation. Proceedings pending publication.